Introduction

The robotic warfare market has gained tremendous momentum in recent years, primarily driven by advancements in artificial intelligence (AI), machine learning (ML), and robotics. With nations around the world seeking cutting-edge technologies to enhance defense capabilities, the market for robotic warfare has seen an upward trajectory, covering applications ranging from autonomous drones to unmanned ground and sea vehicles. This report by International Market Research (IMR) provides an in-depth analysis of the robotic warfare market from 2024 to 2031, including key trends, technological advancements, market segmentation, and future growth projections.

Market Overview

As of 2023, the global robotic warfare market was valued at approximately USD 14.7 billion. Over the forecast period (2024-2031), the market is expected to grow at a compound annual growth rate (CAGR) of around 11.3%, reaching an estimated USD 33.1 billion by 2031. The rise in geopolitical tensions, increased defense spending, and a shift toward automated military systems are among the key factors driving this growth. Additionally, robotic warfare solutions are seen as crucial in reducing human casualties, boosting operational efficiency, and providing strategic advantages.

Key Market Drivers

Market Segmentation Analysis

The robotic warfare market can be segmented by platform type, application, technology, end-use, and region.

By Platform Type

Unmanned Aerial Vehicles (UAVs): UAVs held the largest share of the robotic warfare market in 2023, accounting for approximately 40% of total revenue. These platforms are widely used for surveillance, reconnaissance, and precision strikes.

Unmanned Ground Vehicles (UGVs): UGVs, representing around 30% of the market, are increasingly being deployed for bomb disposal, logistics support, and ground combat roles.

Unmanned Underwater Vehicles (UUVs): The UUV segment accounted for about 15% of the market in 2023. These systems are utilized for underwater surveillance, mine countermeasures, and anti-submarine warfare.

Unmanned Surface Vehicles (USVs): With applications in maritime surveillance and naval combat support, USVs contributed roughly 10% to the market.

Others: Other platforms, including autonomous robotic exoskeletons and robotic combat systems, made up the remaining 5%.

By Application

Surveillance and Reconnaissance: This segment accounted for the largest share of the market in 2023, with approximately 35% of total revenue. Real-time intelligence gathering and monitoring capabilities make surveillance and reconnaissance one of the primary applications of robotic warfare.

Combat Operations: Combat operations contributed around 25% of the market in 2023. Robotic systems used in combat roles are equipped with lethal capabilities, allowing for precision strikes and strategic offensives.

Logistics and Supply Chain Management: This segment represented about 20% of the market. Autonomous vehicles play a critical role in transporting supplies and equipment, especially in challenging terrains.

Mine Countermeasures: Approximately 10% of the market is attributed to robotic systems for mine detection and disposal, reducing risks to human soldiers.

Others: Other applications, including search and rescue, disaster relief, and decontamination, accounted for the remaining 10%.

By Technology

Autonomous Navigation: Autonomous navigation systems held the largest share, representing around 40% of the market in 2023. These technologies enable robotic systems to navigate complex environments without human intervention.

Data Processing and Analytics: Advanced data processing and analytics contributed about 25% of the market. These technologies are critical for real-time data analysis and decision-making.

Communication Systems: Communication technologies, which accounted for approximately 20% of the market, ensure reliable connectivity between robotic platforms and command centers.

Sensors and Actuators: Sensors and actuators, representing roughly 10% of the market, play a crucial role in gathering environmental data and enabling robotic systems to interact with their surroundings.

Others: Other technologies, including cyber defense and AI-based decision-making algorithms, made up the remaining 5%.

By End-Use

Military and Defense: This segment held the largest share of the market in 2023, accounting for approximately 75% of total revenue. Robotic warfare technologies are predominantly used by armed forces for various applications, including combat, surveillance, and logistics.

Intelligence Agencies: Intelligence agencies represented around 15% of the market. These agencies deploy robotic systems for covert surveillance, monitoring, and data collection.

Homeland Security: Homeland security agencies made up about 10% of the market, using robotic systems for border security, disaster response, and counter-terrorism operations.

By Region

North America: North America dominated the robotic warfare market in 2023, accounting for around 40% of total revenue. The region's strong defense budget, high focus on technological advancement, and presence of key industry players are key factors supporting growth.

Europe: Europe accounted for approximately 25% of the market in 2023. The European Union’s investments in defense technologies, combined with rising geopolitical tensions, are contributing to market expansion.

Asia-Pacific: The Asia-Pacific region is expected to see the fastest growth, with a projected CAGR of 13.6% from 2024 to 2031. Increasing defense spending by countries such as China, India, and Japan is driving market growth.

Rest of the World (RoW): Latin America, the Middle East, and Africa collectively accounted for around 15% of the market in 2023. The growing focus on homeland security and counter-terrorism in these regions is expected to contribute to future growth.

The Prominent/Emerging Players in the Robotic Warfare Market Research include:

ELBIT SYSTEMS LTD.

AEROVIRONMENT INC.

ANDURIL INDUSTRIES

BAE SYSTEMS

BOEING

GENERAL ATOMICS

GENERAL DYNAMICS CORPORATION

GHOST ROBOTICS

KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

LOCKHEED MARTIN CORPORATION

MILREM ROBOTICS

NORTHROP GRUMMAN CORPORATION

QINETIQ

RAFAEL ADVANCED DEFENSE SYSTEMS

RHEINMETALL AG

ROBOTEAM

SAFRAN

SARCOS TECHNOLOGY AND ROBOTICS CORPORATION

SHARK ROBOTICS

SPAITECH

TELEDYNE TECHNOLOGIES INCORPORATED

TEXTRON INC.

THALES

TOMAHAWK ROBOTICS

VECNA ROBOTICS

Key Insights

Autonomous Combat Systems: The rise of autonomous combat systems, including lethal autonomous weapons systems (LAWS), is likely to transform the nature of warfare. These systems offer high precision, strategic flexibility, and the ability to operate in high-risk environments without endangering human soldiers.

Collaborative Robotics and Swarm Technology: Swarm technology, where groups of robotic systems operate in unison, is expected to play a crucial role in future warfare. Swarm-based robots can be deployed for large-scale surveillance, area denial, and collective combat missions, providing a significant tactical advantage.

Cybersecurity Concerns: The integration of robotics in warfare has raised concerns about cybersecurity. Robotic systems are vulnerable to hacking and cyber-attacks, which could compromise military operations. Investments in robust cybersecurity solutions are, therefore, essential to ensure the secure operation of robotic warfare systems.

Challenges

Ethical and Legal Issues: The development of autonomous weapons raises ethical and legal concerns, particularly regarding accountability and decision-making in combat scenarios. These issues may lead to stricter regulations and restrictions on the deployment of autonomous robotic systems.

High Costs: The cost of developing and deploying advanced robotic warfare technologies remains high, potentially limiting adoption among smaller nations or organizations with constrained budgets.

Technical Limitations: Despite advancements, robotic warfare systems still face challenges related to battery life, signal disruption, and environmental adaptability, which can limit their effectiveness in certain combat scenarios.

Conclusion

The global robotic warfare market is projected to experience substantial growth from 2024 to 2031, driven by advancements in AI and robotics, rising defense budgets, and a focus on reducing human casualties in combat. North America and Europe are expected to dominate the market, while the Asia-Pacific region is poised to witness the fastest growth. By 2031, the market is anticipated to reach USD 33.1 billion, with unmanned aerial vehicles leading the way in platform type.

However, challenges such as ethical concerns, high costs, and technical limitations must be addressed to realize the full potential of robotic warfare technologies. IMR projects that increased government funding, continued innovation, and collaborations among defense organizations and technology providers will be key factors in driving the future of the robotic warfare market

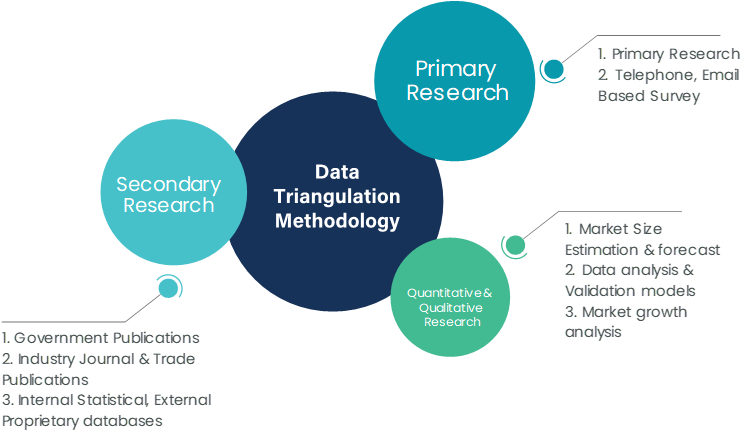

International Market Research follows a comprehensive research methodology dedicated to offering the most accurate market estimation and analysis. It leverages a data triangulation methodology to estimate the market dynamics and deliver precise estimations. The company exploits a combination of top-down and bottom-up approaches for classifying and assessing quantitative aspects of the market.

This research study is based on exhaustive quantitative and qualitative analysis.

The Quantitative analysis involves numerous models, mathematical tools, projection, and sampling techniques. It encompasses the following steps:

Recognize market variables and derive market size.

Valuation of prospects, opportunities, and market penetration rates by analyzing Application Predictive Maintenance Solutionzation, regional trends, etc.

Gauge historical market trends and derive present and future year-on-year growth trends

The qualitative analysis covers briefing about market dynamics and business opportunities and strategies. Lastly, all the research findings are authenticated over interviews with in-house industry experts, freelance consultants, and key opinion leaders, etc.

The preliminary raw data and relevant information are acquired via different sources such as secondary findings, trade surveys, and in-house repositories. Technical issues and trends are attained from technical symposia, surveys, and trade journals. Market dynamics such as driving factors, restraints/challenges, pricing trends, and opportunities are also collected using extensive secondary research via paid and open access data sources.

This info is then filtered to make sure that the related data including market trends, industry dynamics, and outlook is retained for the further research End-user. Data is constantly filtered to confirm that only authenticated sources are measured.

It comprises analysis & mapping of all the data gathered from the above step. It also includes the analysis of data differences observed across numerous data sources and arrives at final data points to be used for final calculations.

This step involves data End-user using various models, mathematical tools, projection, and sampling techniques to derive market findings. It also involves the placement of data points at suitable market spaces to gather viable conclusions.

Market estimates and forecasts are derived via simulation models. Collected data for market dynamics, Propulsion Type sets, pricing trends, and Type development is fed into the model and evaluated simultaneously. These factors are studied on a comparative basis, and their influence over the prediction period is quantified by means of regression, correlation, and time-series exploration. Analyst viewpoint & subject matter expert-based heuristic form of market sizing also plays an essential part in this step.

Some of the parameters measured as a part of the statistical model are:

Macro-economic indicators

Micro-economic indicators

Socio-political indicators

Environmental indicators

Propulsion Type indicators

Validation End-user aids to finalize data points to be used for final calculations. Primary Interviews are conducted to authenticate the data and analysis.

Primary research includes questionnaire-based research, email interactions, online surveys, and telephonic interviews. Interviewees are approached by prominent companies across the value chain including suppliers, Propulsion Type providers, domain experts, and buyers to ensure a holistic and unbiased picture of the market.

Industry participants involved in this research study include:

CEOs, VPs, market intelligence managers

Procuring and national sales managers technical personnel, distributors, and resellers

Research analysts and key opinion leaders from various domains

Our research methodology includes an ideal combination of primary and secondary initiatives.

Source: International Market Research Analysis, 2024

It involves company databases such as Hoover's: This assists us to recognize financial information, the structure of the market participants, and the industry competitive landscape.

The secondary research sources referred to in the End-user are as follows:

Supply Chain and Inventory Managemental bodies, and organizations creating economic policies

National and international social welfare institutions

Company websites, financial reports and SEC filings, broker and investor reports

Related patent and regulatory databases

Statistical databases and market reports

Corporate Presentations, news, press release, and specification sheet of Manufacturers

Open access and paid data sources:

Eurostat

Statista

OneSource

Plastemart

WHO and World Bank

ITU

Factiva

Hoovers

Primary research includes online surveys and telephonic interviews.

Means of primary research: Email interactions, telephonic discussions, and questionnaire-based research, etc.

To validate our research findings and analysis, we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops Research Team’s expertise and market understanding.

Industry participants involved in this research study include:

CEOs, VPs, market intelligence managers

Procuring and national sales managers technical personnel, distributors, and resellers

Research analysts and key opinion leaders from various domains

We employ of following parameters in the absence of concrete data sources:

We assign weights to various parameters and quantify their market influence with the help of weighted average analysis, to derive an expected market growth rate

Income distribution, purchasing pattern, per capita income, and other end-user associated parameters

GDP, inflation rate, per capita disposable income, etc.

Expenditure, financial policies of the country, infrastructure and sector growth, and facilities

Source: International Market Research Analysis, 2024

International Market Research(IMR) is global leader in Market Research & Consulting services.