Executive Summary

The military cloud computing market is poised for robust growth as armed forces worldwide increasingly adopt digital solutions to enhance operational efficiency, data security, and information sharing. Cloud computing in the military sector enables seamless data management, secure communication, and the integration of advanced analytics and artificial intelligence, transforming the decision-making process. International Market Research (IMR) projects that the global military cloud computing market will reach approximately USD 15.8 billion by 2031, growing at a compound annual growth rate (CAGR) of around 13.4% from 2024 to 2031.

Market Overview

Definition and Importance

Military cloud computing involves cloud-based solutions tailored specifically for defense and security purposes. It leverages cloud computing technologies to store, process, and analyze vast amounts of data while ensuring that information is securely accessible only to authorized personnel. Military cloud computing enables rapid data access, efficient resource allocation, and robust cybersecurity, which are critical in modern defense operations.

Market Drivers

Several key factors are propelling the growth of the military cloud computing market:

Challenges

Despite its advantages, the military cloud computing market faces challenges such as:

Market Segmentation

By Deployment Model

By Application

By End-User

Regional Insights

North America

North America currently holds the largest share in the military cloud computing market, accounting for approximately 40% of the global market in 2023. This dominance is attributed to high defense budgets, technological advancements, and early adoption of cloud computing solutions by the U.S. Department of Defense (DoD). IMR projects that North America will continue to lead the market, driven by the adoption of AI and machine learning in cloud-based applications for military purposes.

Europe

Europe is the second-largest market, driven by the defense modernization initiatives in countries like the United Kingdom, Germany, and France. The European military cloud computing market is expected to grow at a CAGR of 12.7% from 2024 to 2031. The European Union's focus on cybersecurity and data privacy also fuels investment in secure cloud solutions for military applications.

Asia-Pacific

The Asia-Pacific region is anticipated to experience the highest growth rate, with a projected CAGR of 15.3% from 2024 to 2031. Rapidly increasing defense expenditures in countries like China, India, Japan, and South Korea, along with rising regional tensions, drive demand for advanced cloud computing solutions in military applications.

Latin America and Middle East & Africa

Though these regions currently hold a smaller share, they are expected to witness steady growth due to defense modernization efforts and investments in cybersecurity infrastructure. Brazil, Saudi Arabia, and Israel are key markets with growing adoption of military cloud solutions.

Market Forecast and Projections (2024 - 2031)

IMR projects the global military cloud computing market to grow from USD 6.5 billion in 2023 to around USD 15.8 billion by 2031, with a CAGR of approximately 13.4% over the forecast period.

Key Players and Competitive Landscape

The military cloud computing market is highly competitive, with several key players holding significant shares. Companies are investing in R&D to enhance security, scalability, and integration with other defense technologies. Some of the top players in the market include:

These companies provide secure cloud computing solutions tailored to military requirements, focusing on data protection, advanced analytics, and seamless integration with defense systems. Partnerships and collaborations with defense organizations are common strategies to expand market presence and address evolving needs.

Trends and Opportunities

1. Rise of AI and Machine Learning in Military Cloud Computing

The integration of AI and machine learning in cloud solutions is transforming military data analysis, allowing for predictive insights and automated threat detection. Cloud-based AI enables enhanced situational awareness and decision-making capabilities.

2. Focus on Cybersecurity and Data Protection

As military data is highly sensitive, cybersecurity remains a top priority in cloud computing. Companies are investing in advanced encryption, multi-factor authentication, and real-time threat detection to secure cloud environments for defense clients.

3. Increased Adoption of Hybrid Cloud Solutions

Many defense organizations prefer hybrid cloud models, allowing them to balance security and flexibility. The hybrid model enables data storage on private clouds for secure information while leveraging public clouds for less sensitive data processing needs.

4. Use of Cloud for Training and Simulation

Cloud computing allows military organizations to use virtual training environments, improving readiness and reducing costs. Cloud-based simulations offer scalable, cost-effective options for training personnel in various scenarios.

Conclusion

The military cloud computing market is set to witness substantial growth as defense organizations increasingly rely on cloud-based solutions for secure data management, operational efficiency, and advanced analytics. According to IMR's projections, the market is expected to grow significantly, reaching around USD 15.8 billion by 2031. The integration of AI, machine learning, and robust cybersecurity measures will drive this growth, enabling military forces to harness the power of data-driven decision-making. As the demand for cost-effective and scalable digital solutions increases, cloud computing will play an indispensable role in modernizing defense infrastructure and enhancing military capabilities globally.

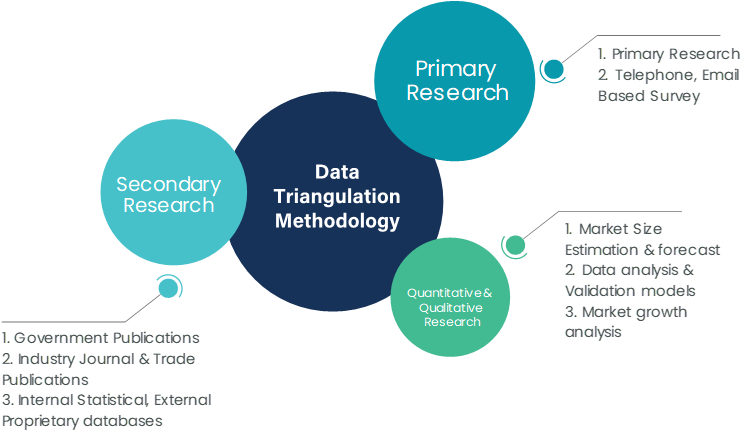

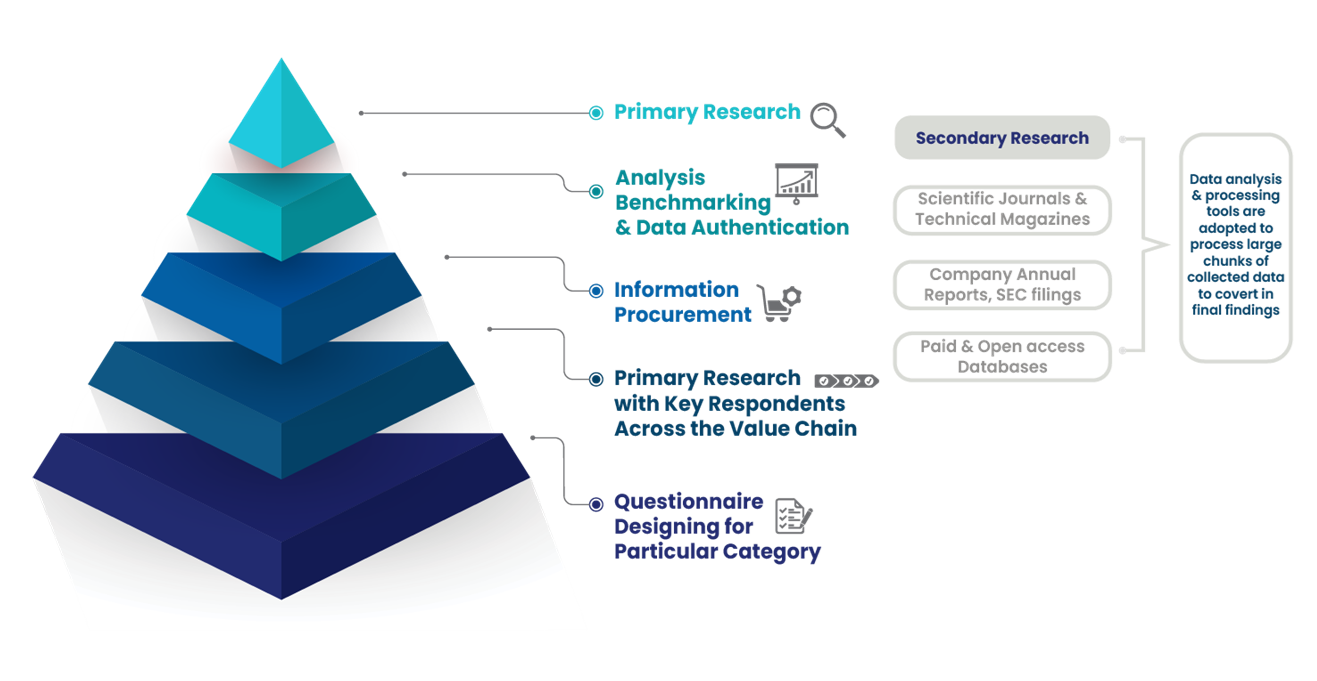

International Market Research follows a comprehensive research methodology dedicated to offering the most accurate market estimation and analysis. It leverages a data triangulation methodology to estimate the market dynamics and deliver precise estimations. The company exploits a combination of top-down and bottom-up approaches for classifying and assessing quantitative aspects of the market.

This research study is based on exhaustive quantitative and qualitative analysis.

The Quantitative analysis involves numerous models, mathematical tools, projection, and sampling techniques. It encompasses the following steps:

Recognize market variables and derive market size.

Valuation of prospects, opportunities, and market penetration rates by analyzing Application Predictive Maintenance Solutionzation, regional trends, etc.

Gauge historical market trends and derive present and future year-on-year growth trends

The qualitative analysis covers briefing about market dynamics and business opportunities and strategies. Lastly, all the research findings are authenticated over interviews with in-house industry experts, freelance consultants, and key opinion leaders, etc.

The preliminary raw data and relevant information are acquired via different sources such as secondary findings, trade surveys, and in-house repositories. Technical issues and trends are attained from technical symposia, surveys, and trade journals. Market dynamics such as driving factors, restraints/challenges, pricing trends, and opportunities are also collected using extensive secondary research via paid and open access data sources.

This info is then filtered to make sure that the related data including market trends, industry dynamics, and outlook is retained for the further research End-user. Data is constantly filtered to confirm that only authenticated sources are measured.

It comprises analysis & mapping of all the data gathered from the above step. It also includes the analysis of data differences observed across numerous data sources and arrives at final data points to be used for final calculations.

This step involves data End-user using various models, mathematical tools, projection, and sampling techniques to derive market findings. It also involves the placement of data points at suitable market spaces to gather viable conclusions.

Market estimates and forecasts are derived via simulation models. Collected data for market dynamics, Propulsion Type sets, pricing trends, and Type development is fed into the model and evaluated simultaneously. These factors are studied on a comparative basis, and their influence over the prediction period is quantified by means of regression, correlation, and time-series exploration. Analyst viewpoint & subject matter expert-based heuristic form of market sizing also plays an essential part in this step.

Some of the parameters measured as a part of the statistical model are:

Macro-economic indicators

Micro-economic indicators

Socio-political indicators

Environmental indicators

Propulsion Type indicators

Validation End-user aids to finalize data points to be used for final calculations. Primary Interviews are conducted to authenticate the data and analysis.

Primary research includes questionnaire-based research, email interactions, online surveys, and telephonic interviews. Interviewees are approached by prominent companies across the value chain including suppliers, Propulsion Type providers, domain experts, and buyers to ensure a holistic and unbiased picture of the market.

Industry participants involved in this research study include:

CEOs, VPs, market intelligence managers

Procuring and national sales managers technical personnel, distributors, and resellers

Research analysts and key opinion leaders from various domains

Our research methodology includes an ideal combination of primary and secondary initiatives.

Source: International Market Research Analysis, 2024

It involves company databases such as Hoover's: This assists us to recognize financial information, the structure of the market participants, and the industry competitive landscape.

The secondary research sources referred to in the End-user are as follows:

Supply Chain and Inventory Managemental bodies, and organizations creating economic policies

National and international social welfare institutions

Company websites, financial reports and SEC filings, broker and investor reports

Related patent and regulatory databases

Statistical databases and market reports

Corporate Presentations, news, press release, and specification sheet of Manufacturers

Open access and paid data sources:

Eurostat

Statista

OneSource

Plastemart

WHO and World Bank

ITU

Factiva

Hoovers

Primary research includes online surveys and telephonic interviews.

Means of primary research: Email interactions, telephonic discussions, and questionnaire-based research, etc.

To validate our research findings and analysis, we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops Research Team’s expertise and market understanding.

Industry participants involved in this research study include:

CEOs, VPs, market intelligence managers

Procuring and national sales managers technical personnel, distributors, and resellers

Research analysts and key opinion leaders from various domains

We employ of following parameters in the absence of concrete data sources:

We assign weights to various parameters and quantify their market influence with the help of weighted average analysis, to derive an expected market growth rate

Income distribution, purchasing pattern, per capita income, and other end-user associated parameters

GDP, inflation rate, per capita disposable income, etc.

Expenditure, financial policies of the country, infrastructure and sector growth, and facilities

Source: International Market Research Analysis, 2024

International Market Research(IMR) is global leader in Market Research & Consulting services.