The metabolism assays market has been growing steadily over the past few years, driven by the increasing need for drug development, biotechnology research, and disease diagnostics. Metabolism assays are crucial in assessing cellular activity, understanding metabolic pathways, and determining how drugs and other compounds interact with cellular metabolism. From testing pharmaceutical compounds to studying genetic diseases, these assays play an indispensable role in modern scientific research. According to International Market Research (IMR), the metabolism assays market is projected to grow significantly between 2024 and 2031, driven by advancements in biotechnology and an increase in personalized medicine approaches.

Market Overview

As of 2023, the global metabolism assays market was valued at approximately USD 1.5 billion. By 2031, IMR estimates that the market will reach around USD 3.1 billion, growing at a compound annual growth rate (CAGR) of approximately 9% over the forecast period. This growth is driven by increased research activities in drug discovery, an aging population with rising chronic disease rates, and the adoption of high-throughput screening methods in laboratories. Additionally, the demand for assays that can quickly and accurately provide metabolic insights has led to increased investment in assay technologies and innovations.

Key Market Drivers

Market Segmentation Analysis

The metabolism assays market can be segmented based on assay type, application, end-user, and region.

By Assay Type

Cell-Based Assays: Cell-based assays accounted for the largest share of the market in 2023, representing approximately 45% of total revenue. They are widely used due to their ability to provide physiologically relevant data and insights into cell metabolism in a controlled environment.

Biochemical Assays: Biochemical assays held around 35% of the market share. These assays are used to measure enzyme activity and metabolite concentrations, making them essential for studying metabolic pathways.

Metabolomics-Based Assays: This segment, though smaller, has been growing rapidly, accounting for about 20% of the market. With the rise of omics-based approaches in life sciences, metabolomics assays have gained popularity, especially in precision medicine.

By Application

Drug Discovery and Development: Drug discovery represented approximately 50% of the metabolism assays market in 2023, making it the largest application segment. Metabolism assays are crucial for assessing drug behavior, toxicity, and efficacy, which are essential for drug development.

Disease Diagnosis: The disease diagnosis segment accounted for around 25% of the market. With metabolic disorders on the rise, the demand for metabolic assays to aid in early diagnosis and personalized treatment is growing.

Nutritional and Toxicity Studies: This segment represented about 15% of the market. Nutritional and toxicity studies use metabolic assays to understand the impact of nutrients and toxins on cellular metabolism.

Others (e.g., Research and Academic Studies): The remaining 10% of the market was contributed by research studies and academic research where metabolism assays are used for fundamental research.

By End-User

Pharmaceutical and Biotechnology Companies: Pharmaceutical and biotech companies dominated the market, accounting for approximately 60% of total revenue in 2023. These companies rely heavily on metabolism assays for drug development and toxicology testing.

Academic and Research Institutes: Academic and research institutes held about 20% of the market, as they perform extensive metabolism studies in disease research, genetics, and molecular biology.

Contract Research Organizations (CROs): CROs made up around 15% of the market. With pharmaceutical companies increasingly outsourcing research, CROs are using metabolism assays for drug testing and clinical trials.

Others (e.g., Diagnostic Centers): Diagnostic centers contributed to the remaining 5% of the market, focusing primarily on the application of metabolism assays in disease diagnostics.

By Region

North America: North America led the market in 2023, accounting for approximately 40% of total revenue, driven by an established pharmaceutical industry and high healthcare expenditure. The region's dominance is further supported by strong R&D activities and advanced healthcare infrastructure.

Europe: Europe held about 25% of the market share, with significant contributions from countries like Germany, France, and the UK. The demand for metabolism assays in Europe is largely driven by advancements in biotechnology and growing adoption of personalized medicine.

Asia-Pacific: Asia-Pacific is expected to witness the highest growth rate over the forecast period, with an estimated CAGR of around 10.5%. Rapid industrialization, expanding healthcare infrastructure, and a growing emphasis on drug development in countries like China and India are boosting demand.

Rest of the World (RoW): Latin America, the Middle East, and Africa collectively represented approximately 10% of the market in 2023. The increasing focus on healthcare infrastructure and disease research is anticipated to support market growth in these regions.

The Prominent/Emerging Players in the Metabolism Assays Market Research include:

NCARDIA

NOVOCIB

ABCAM PLC.

MERCK KGAA

BMG LABTECH

SARTORIUS AG

3H BIOMEDICAL AB

BIOASSAY SYSTEMS

CREATIVE BIOARRAY

EMELCA BIOSCIENCE

ABNOVA CORPORATION

PROMEGA CORPORATION

ETON BIOSCIENCE, INC.

RAYBIOTECH LIFE, INC.

KANEKA EUROGENTEC S.A.

TEMPO BIOSCIENCE, INC.

CAYMAN CHEMICAL COMPANY

ENZO LIFE SCIENCES, INC.

AGILENT TECHNOLOGIES INC.

BIOTREND CHEMIKALIEN GMBH

THERMO FISHER SCIENTIFIC INC.

ELABSCIENCE BIOTECHNOLOGY INC.

Key Insights

Growth of Precision Medicine: As precision medicine gains traction, metabolism assays are becoming integral to patient-specific treatment plans, offering significant potential for market growth.

Rising Government Funding and Support: Governments and health organizations are increasingly funding research initiatives focused on chronic diseases and drug discovery, supporting the expansion of the metabolism assays market.

Expansion in Emerging Economies: Emerging economies, especially in Asia-Pacific and Latin America, are witnessing a growing demand for advanced diagnostic and therapeutic tools, driving the need for metabolism assays in these regions.

Challenges

High Cost of Metabolism Assays: Advanced metabolism assays can be expensive, limiting their accessibility to small laboratories and research institutions, particularly in low-income countries.

Complexity of Metabolic Pathways: The complexity of cellular metabolism poses challenges for researchers, as minor inaccuracies in assays can lead to significant discrepancies in data. Developing more accurate and simplified assays is a challenge for manufacturers.

Stringent Regulatory Requirements: The use of metabolism assays in drug development and diagnostics is subject to strict regulatory standards, which can pose barriers for companies entering the market.

Future Outlook and Opportunities

Looking forward, the metabolism assays market is expected to continue its upward trajectory. The rising prevalence of chronic diseases, advancements in technology, and increased funding for biomedical research are anticipated to drive demand. With increasing emphasis on personalized medicine, there are vast opportunities for companies developing assays that offer high precision and reliability. IMR projects that market leaders will likely invest in expanding their product portfolios, improving assay accuracy, and enhancing automation capabilities to stay competitive.

The Asia-Pacific region offers significant growth potential, as countries such as China, India, and South Korea increasingly invest in biotechnology and healthcare infrastructure. Companies focusing on emerging economies are expected to benefit from untapped market potential and a growing need for advanced metabolic testing solutions.

Conclusion

The metabolism assays market, valued at around USD 1.5 billion in 2023, is projected to reach approximately USD 3.1 billion by 2031, expanding at a CAGR of 9% over the forecast period. This growth is driven by the increasing need for drug development, personalized medicine, and disease diagnosis. Despite challenges such as high assay costs and regulatory hurdles, ongoing innovations in assay technologies are expected to drive market expansion. IMR anticipates that with the right investments in technology and regional expansion, companies operating in the metabolism assays market will experience substantial growth in the coming years.

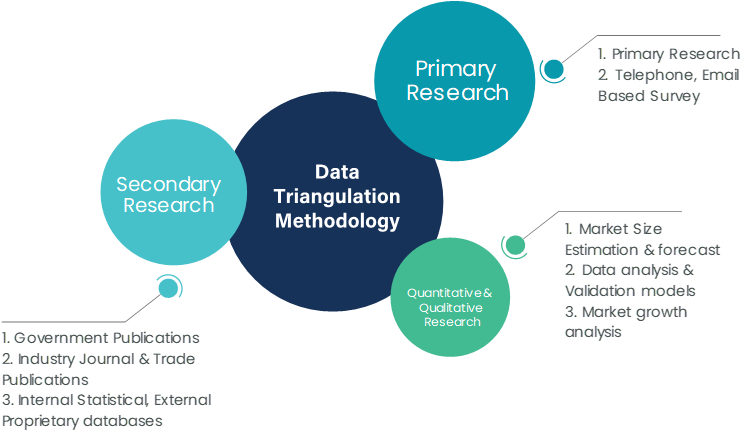

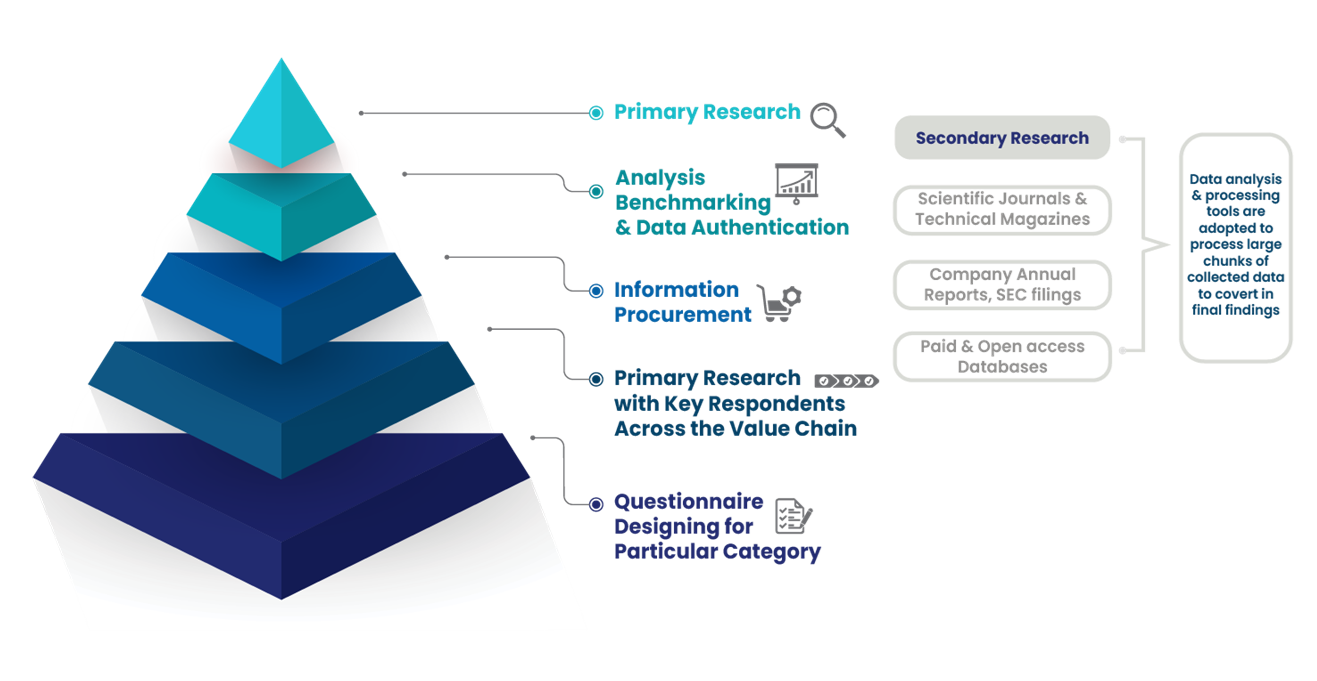

International Market Research follows a comprehensive research methodology dedicated to offering the most accurate market estimation and analysis. It leverages a data triangulation methodology to estimate the market dynamics and deliver precise estimations. The company exploits a combination of top-down and bottom-up approaches for classifying and assessing quantitative aspects of the market.

This research study is based on exhaustive quantitative and qualitative analysis.

The Quantitative analysis involves numerous models, mathematical tools, projection, and sampling techniques. It encompasses the following steps:

Recognize market variables and derive market size.

Valuation of prospects, opportunities, and market penetration rates by analyzing Application Predictive Maintenance Solutionzation, regional trends, etc.

Gauge historical market trends and derive present and future year-on-year growth trends

The qualitative analysis covers briefing about market dynamics and business opportunities and strategies. Lastly, all the research findings are authenticated over interviews with in-house industry experts, freelance consultants, and key opinion leaders, etc.

The preliminary raw data and relevant information are acquired via different sources such as secondary findings, trade surveys, and in-house repositories. Technical issues and trends are attained from technical symposia, surveys, and trade journals. Market dynamics such as driving factors, restraints/challenges, pricing trends, and opportunities are also collected using extensive secondary research via paid and open access data sources.

This info is then filtered to make sure that the related data including market trends, industry dynamics, and outlook is retained for the further research End-user. Data is constantly filtered to confirm that only authenticated sources are measured.

It comprises analysis & mapping of all the data gathered from the above step. It also includes the analysis of data differences observed across numerous data sources and arrives at final data points to be used for final calculations.

This step involves data End-user using various models, mathematical tools, projection, and sampling techniques to derive market findings. It also involves the placement of data points at suitable market spaces to gather viable conclusions.

Market estimates and forecasts are derived via simulation models. Collected data for market dynamics, Propulsion Type sets, pricing trends, and Type development is fed into the model and evaluated simultaneously. These factors are studied on a comparative basis, and their influence over the prediction period is quantified by means of regression, correlation, and time-series exploration. Analyst viewpoint & subject matter expert-based heuristic form of market sizing also plays an essential part in this step.

Some of the parameters measured as a part of the statistical model are:

Macro-economic indicators

Micro-economic indicators

Socio-political indicators

Environmental indicators

Propulsion Type indicators

Validation End-user aids to finalize data points to be used for final calculations. Primary Interviews are conducted to authenticate the data and analysis.

Primary research includes questionnaire-based research, email interactions, online surveys, and telephonic interviews. Interviewees are approached by prominent companies across the value chain including suppliers, Propulsion Type providers, domain experts, and buyers to ensure a holistic and unbiased picture of the market.

Industry participants involved in this research study include:

CEOs, VPs, market intelligence managers

Procuring and national sales managers technical personnel, distributors, and resellers

Research analysts and key opinion leaders from various domains

Our research methodology includes an ideal combination of primary and secondary initiatives.

Source: International Market Research Analysis, 2024

It involves company databases such as Hoover's: This assists us to recognize financial information, the structure of the market participants, and the industry competitive landscape.

The secondary research sources referred to in the End-user are as follows:

Supply Chain and Inventory Managemental bodies, and organizations creating economic policies

National and international social welfare institutions

Company websites, financial reports and SEC filings, broker and investor reports

Related patent and regulatory databases

Statistical databases and market reports

Corporate Presentations, news, press release, and specification sheet of Manufacturers

Open access and paid data sources:

Eurostat

Statista

OneSource

Plastemart

WHO and World Bank

ITU

Factiva

Hoovers

Primary research includes online surveys and telephonic interviews.

Means of primary research: Email interactions, telephonic discussions, and questionnaire-based research, etc.

To validate our research findings and analysis, we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops Research Team’s expertise and market understanding.

Industry participants involved in this research study include:

CEOs, VPs, market intelligence managers

Procuring and national sales managers technical personnel, distributors, and resellers

Research analysts and key opinion leaders from various domains

We employ of following parameters in the absence of concrete data sources:

We assign weights to various parameters and quantify their market influence with the help of weighted average analysis, to derive an expected market growth rate

Income distribution, purchasing pattern, per capita income, and other end-user associated parameters

GDP, inflation rate, per capita disposable income, etc.

Expenditure, financial policies of the country, infrastructure and sector growth, and facilities

Source: International Market Research Analysis, 2024

International Market Research(IMR) is global leader in Market Research & Consulting services.