The ethyleneamine market has witnessed steady growth over recent years, driven by its wide range of industrial applications, including use in personal care products, resins, adhesives, and pharmaceuticals. Ethyleneamines are versatile organic compounds derived from ethylene dichloride, used extensively in various end-use industries for their high reactivity and effective binding capabilities. With a rising demand for products that utilize ethyleneamine derivatives, the market is poised for further expansion from 2024 to 2031. This report by International Market Research (IMR) provides an in-depth analysis of the ethyleneamine market, including its current landscape, market drivers, segmentation analysis, and future projections.

Market Overview

As of 2023, the global ethyleneamine market was valued at approximately USD 2.4 billion. By 2031, IMR projects the market to reach an estimated USD 4.2 billion, registering a compound annual growth rate (CAGR) of around 7.2% over the forecast period. Key factors fueling this growth include the rising demand in end-use industries such as pharmaceuticals, water treatment, and agriculture. Additionally, innovations in production processes and product formulations are expected to bolster market expansion, particularly in emerging economies where industrial growth is strong.

Key Market Drivers

Market Segmentation Analysis

The ethyleneamine market can be segmented by product type, application, end-use industry, and region.

By Product Type

Ethylenediamine (EDA): Ethylenediamine is the most widely used ethyleneamine and held the largest market share in 2023, accounting for approximately 40% of total revenue. EDA is primarily used in agrochemicals, personal care products, and water treatment chemicals.

Diethylenetriamine (DETA): Diethylenetriamine represented around 30% of the market in 2023. It is commonly utilized in epoxy resin hardeners, corrosion inhibitors, and lube oil additives.

Triethylenetetramine (TETA): TETA accounted for about 15% of the market and finds applications in the production of polyamide resins, oilfield chemicals, and adhesives.

Others (e.g., TEPA, PEHA): Other ethyleneamines, including tetraethylenepentamine (TEPA) and pentaethylenehexamine (PEHA), made up the remaining 15%. These products are used in specialty applications requiring unique chemical properties.

By Application

Agrochemicals: Agrochemicals accounted for around 25% of the ethyleneamine market in 2023, as these compounds are widely used in the synthesis of herbicides and fungicides.

Water Treatment: The water treatment segment represented approximately 20% of the market, driven by the need for effective chemicals that ensure safe water processing and wastewater management.

Pharmaceuticals: With about 18% of the market share, pharmaceuticals are a key application area for ethyleneamines. Their use in drug synthesis and formulation plays a vital role in the healthcare industry.

Epoxy Resins and Adhesives: This segment accounted for 15% of the market, driven by demand from construction, automotive, and electronics industries.

Personal Care Products: Ethyleneamines are increasingly used in personal care applications, accounting for about 10% of the market. They are utilized as conditioning agents in hair care products and emulsifiers in skincare formulations.

Others (e.g., Oilfield Chemicals, Textiles): Other applications, including oilfield chemicals and textile processing, contributed to the remaining 12% of the market.

By End-Use Industry

Agriculture: The agricultural sector held the largest share, accounting for around 30% of the market in 2023, due to its extensive use of ethyleneamines in agrochemical production.

Pharmaceutical and Healthcare: This industry represented approximately 25% of the market. With increasing R&D investments in pharmaceuticals, demand for ethyleneamines is expected to rise.

Water Treatment Industry: Water treatment accounted for 18% of the market. This industry’s reliance on ethyleneamines to treat and manage water resources is expected to drive growth over the forecast period.

Construction and Automotive: Together, these sectors accounted for 17% of the market. They primarily utilize ethyleneamine-based resins and adhesives.

Others: Other industries, including personal care, textiles, and oil and gas, contributed to the remaining 10%.

By Region

North America: North America dominated the ethyleneamine market in 2023, accounting for approximately 35% of total revenue. The region’s established chemical and pharmaceutical industries, coupled with high demand for agrochemicals, drive this market’s growth.

Europe: Europe accounted for about 25% of the market, with major players in the pharmaceutical and water treatment industries contributing to the demand for ethyleneamines.

Asia-Pacific: Asia-Pacific is expected to witness the fastest growth, with a projected CAGR of around 8.5% from 2024 to 2031. The rapid industrialization in countries like China, India, and Japan is expected to significantly boost demand.

Rest of the World (RoW): Latin America, the Middle East, and Africa collectively accounted for about 15% of the market in 2023. Growing focus on agriculture and water treatment solutions in these regions is anticipated to drive future growth.

The Prominent/Emerging Players in the Ethyleneamine Market Research include:

BALAJI SPECIALITY CHEMICALS LIMITED

BASF SE

DIAMINES AND CHEMICALS LTD.

Dow Chemical Company

GFS CHEMICALS, INC.

HUNTSMAN CORPORATION

KANTO CHEMICAL CO., INC.

NOURYON

OAKWOOD PRODUCTS, INC.

ORIENTAL UNION CHEMICAL CORPORATION

SABIC

TOSOH CORPORATION

AkzoNobel N.V.

Alkyl Amines Chemicals Ltd.

Arabian Amines Company

Delamine B.V.

Eastman Chemical Company

Indo Amines Ltd.

Invista

LyondellBasell Industries N.V.

Prasol Chemicals Pvt. Ltd.

Sadara Chemical Company

Sigma-Aldrich Corporation

Wuxi Yangshi Chemical Co., Ltd.

Key Insights

Expansion in Emerging Markets: Emerging markets, particularly in Asia-Pacific and Latin America, are anticipated to experience significant growth in the ethyleneamine market due to expanding industrial activities and growing demand for agricultural products.

Sustainable Product Development: Sustainability is a growing trend in the ethyleneamine market. Companies are investing in eco-friendly and low-toxicity formulations to meet regulatory standards and address environmental concerns.

Rise of Bio-Based Alternatives: The increasing preference for bio-based chemicals is influencing the ethyleneamine market. Although bio-based ethyleneamines are still in early stages, they are expected to gain traction in the future as industries move toward greener alternatives.

Challenges

Regulatory Compliance: The ethyleneamine industry faces stringent environmental regulations due to the potential toxicity and environmental impact of these chemicals. Manufacturers need to ensure compliance with environmental standards, which could increase production costs.

Fluctuations in Raw Material Prices: The prices of raw materials used in ethyleneamine production, such as ethylene and ammonia, are subject to market fluctuations. Volatile raw material prices may affect profit margins and impact market growth.

Health and Safety Concerns: Ethyleneamines are hazardous chemicals that require careful handling. Health and safety concerns in their manufacturing, storage, and transportation may pose challenges to market expansion.

Conclusion

The ethyleneamine market is projected to grow steadily over the forecast period, with a projected value of USD 4.2 billion by 2031. Factors such as increasing demand in pharmaceuticals, agrochemicals, and water treatment, along with advancements in product formulations, are expected to drive market growth. North America and Europe currently hold significant shares of the market, while Asia-Pacific is poised for the highest growth rate due to rapid industrialization and economic expansion.

Despite the positive outlook, challenges such as regulatory compliance, fluctuating raw material prices, and health concerns need to be addressed. IMR expects that the adoption of sustainable practices, expansion in emerging markets, and product innovation will be key strategies for market players to ensure sustained growth in the ethyleneamine market.

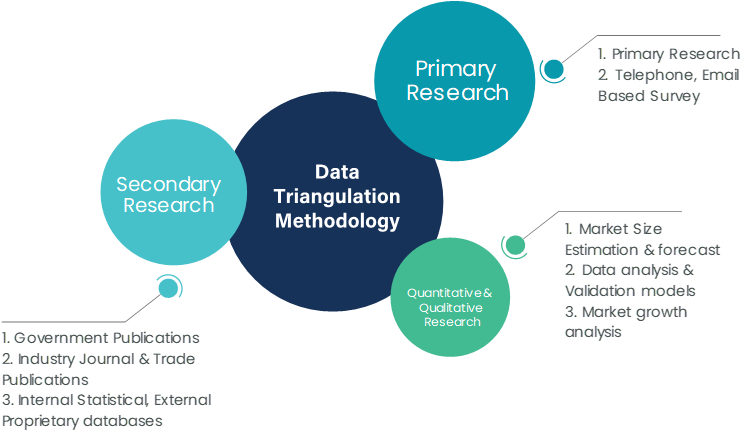

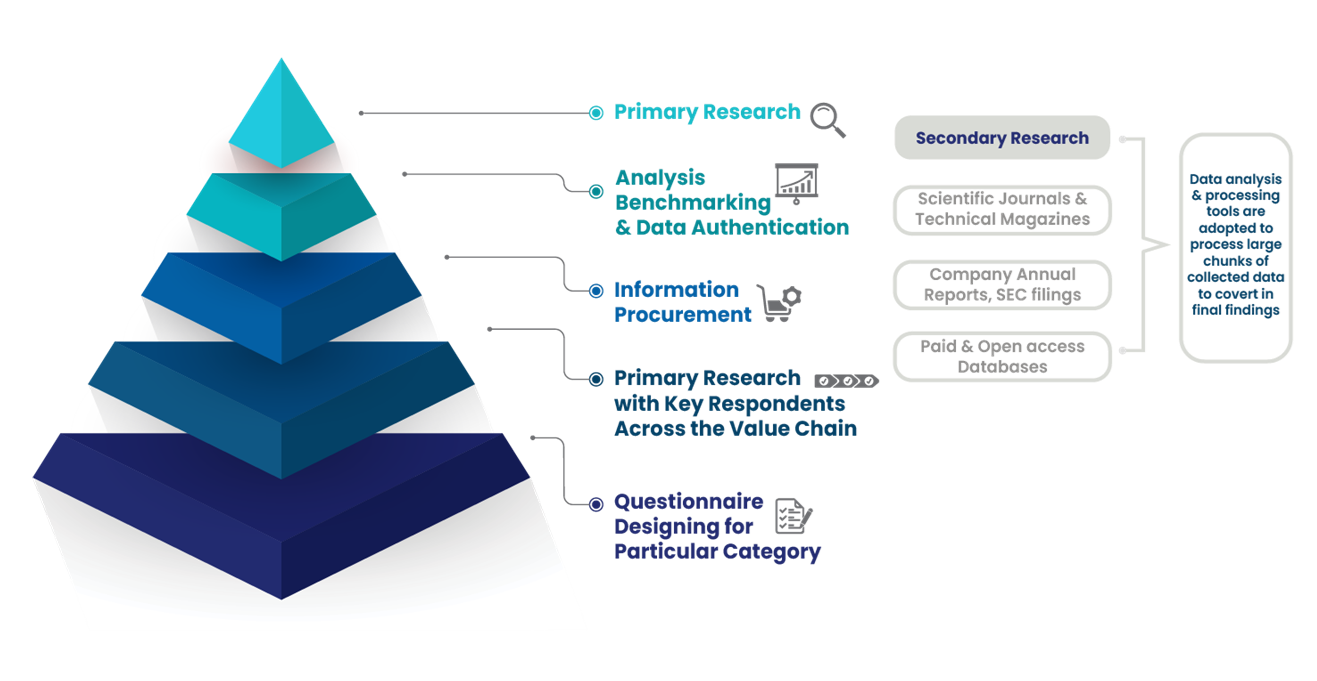

International Market Research follows a comprehensive research methodology dedicated to offering the most accurate market estimation and analysis. It leverages a data triangulation methodology to estimate the market dynamics and deliver precise estimations. The company exploits a combination of top-down and bottom-up approaches for classifying and assessing quantitative aspects of the market.

This research study is based on exhaustive quantitative and qualitative analysis.

The Quantitative analysis involves numerous models, mathematical tools, projection, and sampling techniques. It encompasses the following steps:

Recognize market variables and derive market size.

Valuation of prospects, opportunities, and market penetration rates by analyzing Application Predictive Maintenance Solutionzation, regional trends, etc.

Gauge historical market trends and derive present and future year-on-year growth trends

The qualitative analysis covers briefing about market dynamics and business opportunities and strategies. Lastly, all the research findings are authenticated over interviews with in-house industry experts, freelance consultants, and key opinion leaders, etc.

The preliminary raw data and relevant information are acquired via different sources such as secondary findings, trade surveys, and in-house repositories. Technical issues and trends are attained from technical symposia, surveys, and trade journals. Market dynamics such as driving factors, restraints/challenges, pricing trends, and opportunities are also collected using extensive secondary research via paid and open access data sources.

This info is then filtered to make sure that the related data including market trends, industry dynamics, and outlook is retained for the further research End-user. Data is constantly filtered to confirm that only authenticated sources are measured.

It comprises analysis & mapping of all the data gathered from the above step. It also includes the analysis of data differences observed across numerous data sources and arrives at final data points to be used for final calculations.

This step involves data End-user using various models, mathematical tools, projection, and sampling techniques to derive market findings. It also involves the placement of data points at suitable market spaces to gather viable conclusions.

Market estimates and forecasts are derived via simulation models. Collected data for market dynamics, Propulsion Type sets, pricing trends, and Type development is fed into the model and evaluated simultaneously. These factors are studied on a comparative basis, and their influence over the prediction period is quantified by means of regression, correlation, and time-series exploration. Analyst viewpoint & subject matter expert-based heuristic form of market sizing also plays an essential part in this step.

Some of the parameters measured as a part of the statistical model are:

Macro-economic indicators

Micro-economic indicators

Socio-political indicators

Environmental indicators

Propulsion Type indicators

Validation End-user aids to finalize data points to be used for final calculations. Primary Interviews are conducted to authenticate the data and analysis.

Primary research includes questionnaire-based research, email interactions, online surveys, and telephonic interviews. Interviewees are approached by prominent companies across the value chain including suppliers, Propulsion Type providers, domain experts, and buyers to ensure a holistic and unbiased picture of the market.

Industry participants involved in this research study include:

CEOs, VPs, market intelligence managers

Procuring and national sales managers technical personnel, distributors, and resellers

Research analysts and key opinion leaders from various domains

Our research methodology includes an ideal combination of primary and secondary initiatives.

Source: International Market Research Analysis, 2024

It involves company databases such as Hoover's: This assists us to recognize financial information, the structure of the market participants, and the industry competitive landscape.

The secondary research sources referred to in the End-user are as follows:

Supply Chain and Inventory Managemental bodies, and organizations creating economic policies

National and international social welfare institutions

Company websites, financial reports and SEC filings, broker and investor reports

Related patent and regulatory databases

Statistical databases and market reports

Corporate Presentations, news, press release, and specification sheet of Manufacturers

Open access and paid data sources:

Eurostat

Statista

OneSource

Plastemart

WHO and World Bank

ITU

Factiva

Hoovers

Primary research includes online surveys and telephonic interviews.

Means of primary research: Email interactions, telephonic discussions, and questionnaire-based research, etc.

To validate our research findings and analysis, we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops Research Team’s expertise and market understanding.

Industry participants involved in this research study include:

CEOs, VPs, market intelligence managers

Procuring and national sales managers technical personnel, distributors, and resellers

Research analysts and key opinion leaders from various domains

We employ of following parameters in the absence of concrete data sources:

We assign weights to various parameters and quantify their market influence with the help of weighted average analysis, to derive an expected market growth rate

Income distribution, purchasing pattern, per capita income, and other end-user associated parameters

GDP, inflation rate, per capita disposable income, etc.

Expenditure, financial policies of the country, infrastructure and sector growth, and facilities

Source: International Market Research Analysis, 2024

International Market Research(IMR) is global leader in Market Research & Consulting services.