The global Broaching Machine Market is projected to witness steady growth from 2024 to 2031, driven by the increasing demand for precision machining and the rising adoption of automated manufacturing processes. Broaching machines are used to create highly accurate and intricate geometries in metal workpieces. These machines are primarily used in industries such as automotive, aerospace, industrial machinery, and defense, where precision and speed are critical for producing components with complex shapes.

The market for broaching machines is being propelled by the need for faster production cycles, reduced manual intervention, and enhanced product quality. International Market Research (IMR) estimates that the broaching machine market was valued at approximately $761.4 million in 2023, and it is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2031, reaching a market value of around $1.2 billion by 2031.

Market Overview

The growth of the broaching machine market is attributed to technological advancements in manufacturing processes and the increasing automation in industries. Broaching machines are favored for their ability to produce precision components with complex profiles in a cost-effective and time-efficient manner.

Key Drivers of Growth:

Segmentation Analysis

1. By MachineType

Among these, vertical broaching machines accounted for the largest share of the market in 2023, with approximately 57.3% of the total revenue. This dominance is due to the versatility and wide application of vertical broaching machines in industries such as automotive, aerospace, and heavy machinery. These machines are preferred for their ability to handle large workpieces and perform precise internal and external broaching.

Horizontal broaching machines, on the other hand, are projected to witness faster growth during the forecast period, with a CAGR of 6.3% from 2024 to 2031. These machines are increasingly used in the production of smaller components and are gaining popularity due to their compact design and efficiency.

2. By End-Use Industry

The automotive sector held the largest share of the broaching machine market in 2023, accounting for around 42.7% of the market. The increasing production of electric vehicles (EVs) and the rising demand for lightweight automotive components are driving the adoption of broaching machines in this industry. IMR projects that the automotive sector will continue to dominate the market, though its share may slightly decline as other sectors, such as aerospace and industrial machinery, grow at a faster pace.

The aerospace industry is expected to experience the highest CAGR of 6.5% during the forecast period, driven by the need for lightweight, precision-engineered components in aircraft manufacturing. The increasing focus on reducing aircraft weight and improving fuel efficiency is leading to greater demand for broaching machines in this sector.

3. By Region

In terms of regional analysis, Asia-Pacific is expected to be the fastest-growing market for broaching machines, with a CAGR of 7.1% from 2024 to 2031. The region is experiencing rapid industrialization and urbanization, particularly in countries like China, India, and Japan, where the automotive and manufacturing sectors are expanding. The growing demand for precision-engineered components in these regions is driving the need for broaching machines.

North America held the largest market share in 2023, accounting for approximately 38.5% of the global market. This dominance is attributed to the presence of well-established automotive and aerospace industries in the U.S. and Canada. However, the growth rate in North America is expected to be moderate compared to Asia-Pacific due to market saturation.

Key Market Trends

Challenges

Future Outlook and Opportunities

The broaching machine market offers numerous growth opportunities over the forecast period, particularly in regions experiencing rapid industrial growth and technological advancements. The increasing demand for automated and CNC-controlled broaching machines, coupled with the rising focus on precision engineering and lightweight materials, is expected to drive market expansion.

Key Players

Accu-Cut Diamond Tool Co.

American Broach & Machine Company

Nachi-Fujikoshi Corp.

Broaching Machine Specialties (BMS)

Mitsubishi Heavy Industries Machine Tool Co., Ltd.

Stenhoj Hydraulik A/S

The Ohio Broach & Machine Co.

Colonial Tool Group Inc.

Ekin S. Coop

Pioneer Broach Company

Somma Tool Company

V.W. Broaching Service Inc.

Forst Technologie GmbH & Co. KG

Arthur Klink GmbH

Dorstener Maschinenfabrik (Dorma)

Apex Broaching Systems

Sun Tech Tools

Ty Miles, Inc.

Schwanog Siegfried Güntert GmbH

Miller Broach

Conclusion

The Broaching Machine Market is set for steady growth between 2024 and 2031, driven by increasing demand from key industries such as automotive, aerospace, and industrial machinery. Technological advancements, particularly in automation and CNC-controlled systems, are further enhancing the capabilities of broaching machines, making them indispensable in modern manufacturing processes. Although challenges such as high costs and skilled labor shortages exist, the overall outlook for the broaching machine market is positive. IMR projects that the market will continue to expand, with opportunities for growth in emerging markets, advanced technologies, and new industries.

Source: International Market Research Analysis, 2024

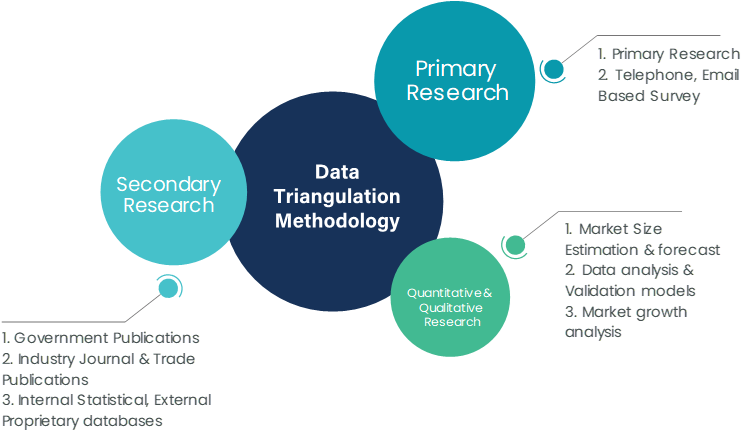

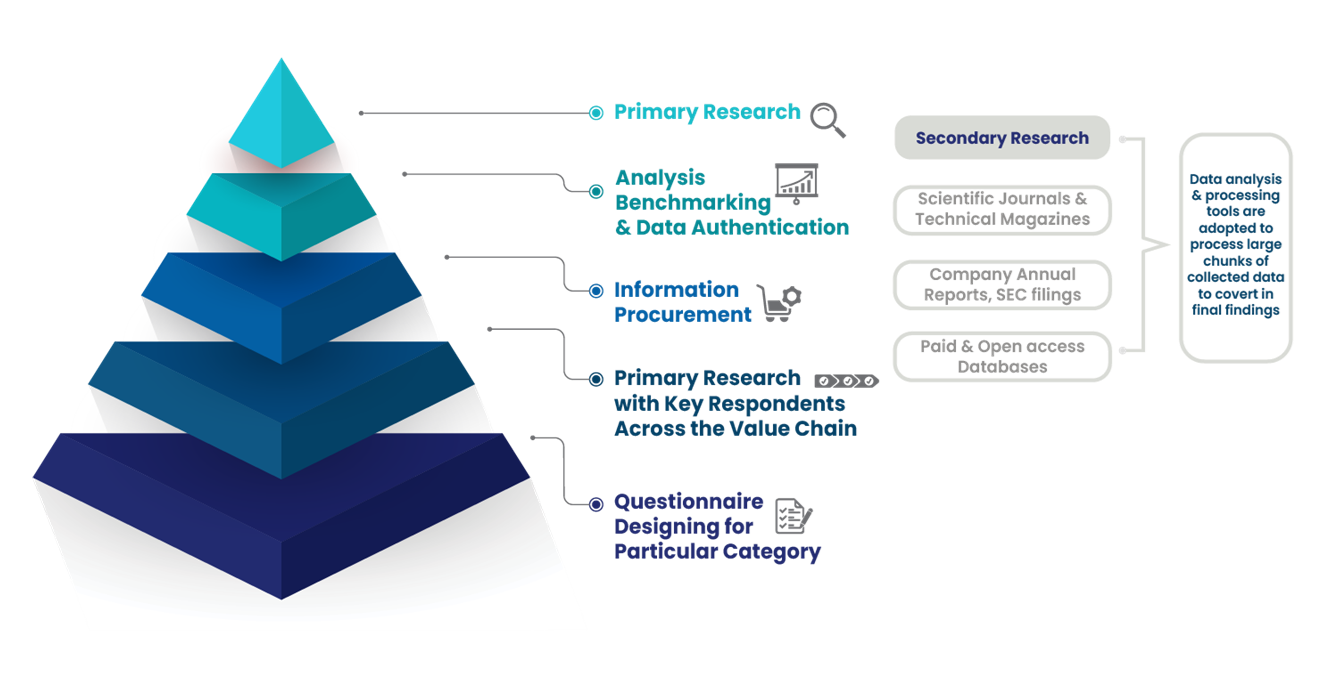

International Market Research follows a comprehensive research methodology dedicated to offering the most accurate market estimation and analysis. It leverages a data triangulation methodology to estimate the market dynamics and deliver precise estimations. The company exploits a combination of top-down and bottom-up approaches for classifying and assessing quantitative aspects of the market.

This research study is based on exhaustive quantitative and qualitative analysis.

The Quantitative analysis involves numerous models, mathematical tools, projection, and sampling techniques. It encompasses the following steps:

Recognize market variables and derive market size.

Valuation of prospects, opportunities, and market penetration rates by analyzing Application Predictive Maintenance Solution, regional trends, etc.

Gauge historical market trends and derive present and future year-on-year growth trends

The qualitative analysis covers briefing about market dynamics and business opportunities and strategies. Lastly, all the research findings are authenticated over interviews with in-house industry experts, freelance consultants, and key opinion leaders, etc.

The preliminary raw data and relevant information are acquired via different sources such as secondary findings, trade surveys, and in-house repositories. Technical issues and trends are attained from technical symposia, surveys, and trade journals. Market dynamics such as driving factors, restraints/challenges, pricing trends, and opportunities are also collected using extensive secondary research via paid and open access data sources.

This info is then filtered to make sure that the related data including market trends, industry dynamics, and outlook is retained for the further research End-user. Data is constantly filtered to confirm that only authenticated sources are measured.

It comprises analysis & mapping of all the data gathered from the above step. It also includes the analysis of data differences observed across numerous data sources and arrives at final data points to be used for final calculations.

This step involves data End-user using various models, mathematical tools, projection, and sampling techniques to derive market findings. It also involves the placement of data points at suitable market spaces to gather viable conclusions.

Market estimates and forecasts are derived via simulation models. Collected data for market dynamics, Propulsion Type sets, pricing trends, and Type development is fed into the model and evaluated simultaneously. These factors are studied on a comparative basis, and their influence over the prediction period is quantified by means of regression, correlation, and time-series exploration. Analyst viewpoint & subject matter expert-based heuristic form of market sizing also plays an essential part in this step.

Some of the parameters measured as a part of the statistical model are:

Macro-economic indicators

Micro-economic indicators

Socio-political indicators

Environmental indicators

Propulsion Type indicators

Validation End-user aids to finalize data points to be used for final calculations. Primary Interviews are conducted to authenticate the data and analysis.

Primary research includes questionnaire-based research, email interactions, online surveys, and telephonic interviews. Interviewees are approached by prominent companies across the value chain including suppliers, Propulsion Type providers, domain experts, and buyers to ensure a holistic and unbiased picture of the market.

Industry participants involved in this research study include:

CEOs, VPs, market intelligence managers

Procuring and national sales managers technical personnel, distributors, and resellers

Research analysts and key opinion leaders from various domains

Our research methodology includes an ideal combination of primary and secondary initiatives.

Source: International Market Research Analysis, 2024

It involves company databases such as Hoover's: This assists us to recognize financial information, the structure of the market participants, and the industry competitive landscape.

The secondary research sources referred to in the End-user are as follows:

Supply Chain and Inventory Managemental bodies, and organizations creating economic policies

National and international social welfare institutions

Company websites, financial reports and SEC filings, broker and investor reports

Related patent and regulatory databases

Statistical databases and market reports

Corporate Presentations, news, press release, and specification sheet of Manufacturers

Open access and paid data sources:

Eurostat

Statista

OneSource

Plastemart

WHO and World Bank

ITU

Factiva

Hoovers

Primary research includes online surveys and telephonic interviews.

Means of primary research: Email interactions, telephonic discussions, and questionnaire-based research, etc.

To validate our research findings and analysis, we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops Research Team’s expertise and market understanding.

Industry participants involved in this research study include:

CEOs, VPs, market intelligence managers

Procuring and national sales managers technical personnel, distributors, and resellers

Research analysts and key opinion leaders from various domains

We employ of following parameters in the absence of concrete data sources:

We assign weights to various parameters and quantify their market influence with the help of weighted average analysis, to derive an expected market growth rate

Income distribution, purchasing pattern, per capita income, and other end-user associated parameters

GDP, inflation rate, per capita disposable income, etc.

Expenditure, financial policies of the country, infrastructure and sector growth, and facilities

Source: International Market Research Analysis, 2024

International Market Research(IMR) is global leader in Market Research & Consulting services.