The global animal parasiticides market is essential in protecting livestock and companion animals from parasitic infections, which can affect animal health, productivity, and the welfare of animals and humans. Animal parasiticides, including ectoparasiticides, endoparasiticides, and endectocides, target external and internal parasites, ensuring the health of livestock, which is integral for food security, and companion animals. According to projections by International Market Research (IMR), the animal parasiticides market is expected to experience strong growth from 2024 to 2031, driven by rising demand for animal healthcare, the intensifying livestock industry, and an increasing pet population globally.

Market Overview

The global animal parasiticides market was estimated at approximately USD 9.2 billion in 2023 and is projected to reach around USD 13.5 billion by 2031, with a compound annual growth rate (CAGR) of about 5.1% during this period. The demand for parasiticides is being bolstered by the need to protect animals from parasitic infections that can lead to significant economic losses in the livestock sector. Additionally, the growth of the pet care industry, especially in regions with rising disposable incomes, is contributing to the increasing adoption of parasiticides for companion animals.

Key Market Drivers

Market Segmentation Analysis

The animal parasiticides market can be segmented based on product type, animal type, and region.

By Product Type

Ectoparasiticides: Accounting for approximately 40% of the market, ectoparasiticides target external parasites such as fleas, ticks, and mites. They are commonly used for both livestock and companion animals and are available in sprays, powders, and topical applications.

Endoparasiticides: Representing around 35% of the market, endoparasiticides are effective against internal parasites like worms. These products are frequently used in livestock to prevent gastrointestinal infections that can impair growth and productivity.

Endectocides: Endectocides, with about 25% of the market share, provide dual protection against both external and internal parasites. They are gaining popularity due to their broad-spectrum efficacy.

By Animal Type

Livestock: The livestock segment holds the largest share, accounting for nearly 60% of the market. This segment includes cattle, sheep, poultry, and swine. Effective parasite control is essential in livestock farming to prevent productivity losses and ensure animal health.

Companion Animals: Companion animals make up approximately 40% of the market. The rising pet population, especially in developed countries, and the willingness of pet owners to invest in healthcare products are driving growth in this segment.

By Region

North America: North America leads the global animal parasiticides market, accounting for about 35% of the total market share. High awareness of pet healthcare, extensive livestock farming, and the presence of key industry players contribute to North America’s dominance.

Europe: Europe follows closely, holding around 30% of the market share. The region has stringent animal health regulations, especially in countries like Germany, France, and the UK, and a well-established livestock sector.

Asia-Pacific: Asia-Pacific is projected to experience the highest CAGR, holding about 25% of the market share. Rapid urbanization, growing disposable incomes, and the rising adoption of pets in countries such as China, India, and Japan drive demand for animal parasiticides.

Rest of the World (RoW): Latin America, the Middle East, and Africa collectively hold approximately 10% of the market. Livestock farming and increasing awareness of animal health in these regions are expected to boost market growth.

The Prominent/Emerging Players in the Animal Parasiticides Market Research include:

CALIER

UCBVET

VIRBAC

NORBROOK

KRKA GROUP

PETIQ, LLC

VETANCO SA

ZOETIS INC.

PRN PHARMACAL

BIOGÉNESIS BAGÓ

CHANELLE PHARMA

VETOQUINOL S.A.

MERCK & CO., INC

CEVA SANTÉ ANIMALE

BIMEDA ANIMAL HEALTH

BRILLIANT BIO PHARMA

SMARTVET HOLDINGS, INC.

BOEHRINGER INGELHEIM GMBH

SEQUENT SCIENTIFIC LIMITED

ECO ANIMAL HEALTH GROUP PLC

ABBEY ANIMAL HEALTH PTY LTD.

KYORITSU SEIYAKU CORPORATION

LUTIM PHARMA PRIVATE LIMITED

ELANCO ANIMAL HEALTH INCORPORATED

Key Insights

Challenges

Future Outlook and Opportunities

The animal parasiticides market is poised for steady growth due to the ongoing demand for parasite control solutions in both livestock and companion animals. The emphasis on sustainability and animal welfare is expected to drive innovation in product formulations and encourage manufacturers to develop environmentally friendly options. The Asia-Pacific region, with its rising pet population and expanding livestock industry, presents significant growth opportunities.

In addition, the companion animal segment will likely benefit from increased pet insurance coverage and a higher focus on preventive healthcare. Industry players are expected to focus on expanding their product portfolios to include multi-spectrum parasiticides that offer convenience and efficacy, further enhancing market growth.

Conclusion

The global animal parasiticides market, valued at around USD 9.2 billion in 2023, is projected to grow to approximately USD 13.5 billion by 2031, with a CAGR of 5.1%. Driven by rising pet ownership, advancements in parasiticide formulations, and increasing awareness of zoonotic diseases, the market is set to witness considerable growth. As regulations tighten and consumer awareness of environmental impact increases, the demand for sustainable and effective parasiticides will continue to shape the future of this market.

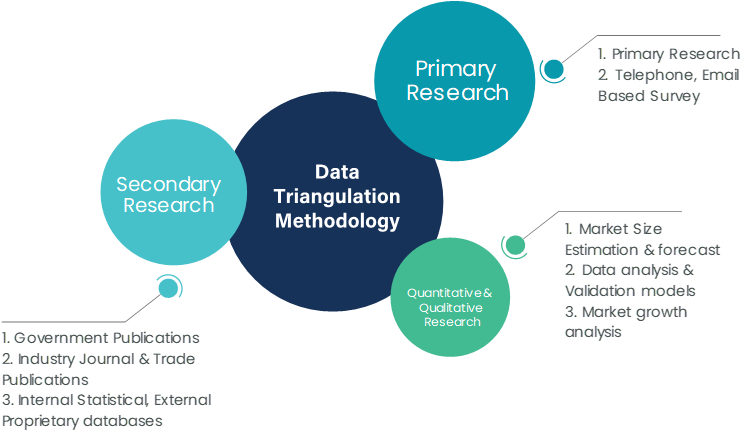

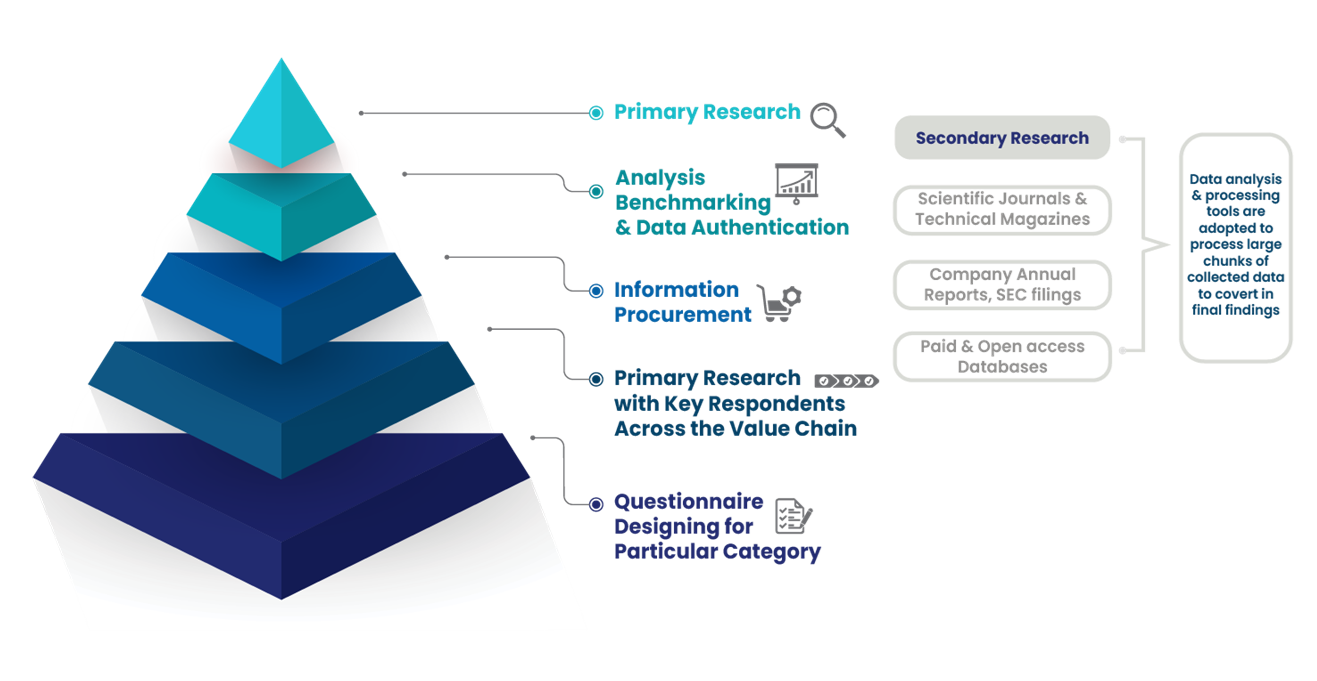

International Market Research follows a comprehensive research methodology dedicated to offering the most accurate market estimation and analysis. It leverages a data triangulation methodology to estimate the market dynamics and deliver precise estimations. The company exploits a combination of top-down and bottom-up approaches for classifying and assessing quantitative aspects of the market.

This research study is based on exhaustive quantitative and qualitative analysis.

The Quantitative analysis involves numerous models, mathematical tools, projection, and sampling techniques. It encompasses the following steps:

Recognize market variables and derive market size.

Valuation of prospects, opportunities, and market penetration rates by analyzing Application Predictive Maintenance Solutionzation, regional trends, etc.

Gauge historical market trends and derive present and future year-on-year growth trends

The qualitative analysis covers briefing about market dynamics and business opportunities and strategies. Lastly, all the research findings are authenticated over interviews with in-house industry experts, freelance consultants, and key opinion leaders, etc.

The preliminary raw data and relevant information are acquired via different sources such as secondary findings, trade surveys, and in-house repositories. Technical issues and trends are attained from technical symposia, surveys, and trade journals. Market dynamics such as driving factors, restraints/challenges, pricing trends, and opportunities are also collected using extensive secondary research via paid and open access data sources.

This info is then filtered to make sure that the related data including market trends, industry dynamics, and outlook is retained for the further research End-user. Data is constantly filtered to confirm that only authenticated sources are measured.

It comprises analysis & mapping of all the data gathered from the above step. It also includes the analysis of data differences observed across numerous data sources and arrives at final data points to be used for final calculations.

This step involves data End-user using various models, mathematical tools, projection, and sampling techniques to derive market findings. It also involves the placement of data points at suitable market spaces to gather viable conclusions.

Market estimates and forecasts are derived via simulation models. Collected data for market dynamics, Propulsion Type sets, pricing trends, and Type development is fed into the model and evaluated simultaneously. These factors are studied on a comparative basis, and their influence over the prediction period is quantified by means of regression, correlation, and time-series exploration. Analyst viewpoint & subject matter expert-based heuristic form of market sizing also plays an essential part in this step.

Some of the parameters measured as a part of the statistical model are:

Macro-economic indicators

Micro-economic indicators

Socio-political indicators

Environmental indicators

Propulsion Type indicators

Validation End-user aids to finalize data points to be used for final calculations. Primary Interviews are conducted to authenticate the data and analysis.

Primary research includes questionnaire-based research, email interactions, online surveys, and telephonic interviews. Interviewees are approached by prominent companies across the value chain including suppliers, Propulsion Type providers, domain experts, and buyers to ensure a holistic and unbiased picture of the market.

Industry participants involved in this research study include:

CEOs, VPs, market intelligence managers

Procuring and national sales managers technical personnel, distributors, and resellers

Research analysts and key opinion leaders from various domains

Our research methodology includes an ideal combination of primary and secondary initiatives.

Source: International Market Research Analysis, 2024

It involves company databases such as Hoover's: This assists us to recognize financial information, the structure of the market participants, and the industry competitive landscape.

The secondary research sources referred to in the End-user are as follows:

Supply Chain and Inventory Managemental bodies, and organizations creating economic policies

National and international social welfare institutions

Company websites, financial reports and SEC filings, broker and investor reports

Related patent and regulatory databases

Statistical databases and market reports

Corporate Presentations, news, press release, and specification sheet of Manufacturers

Open access and paid data sources:

Eurostat

Statista

OneSource

Plastemart

WHO and World Bank

ITU

Factiva

Hoovers

Primary research includes online surveys and telephonic interviews.

Means of primary research: Email interactions, telephonic discussions, and questionnaire-based research, etc.

To validate our research findings and analysis, we conduct primary interviews of key industry participants. Insights from primary respondents help in validating the secondary research findings. It also develops Research Team’s expertise and market understanding.

Industry participants involved in this research study include:

CEOs, VPs, market intelligence managers

Procuring and national sales managers technical personnel, distributors, and resellers

Research analysts and key opinion leaders from various domains

We employ of following parameters in the absence of concrete data sources:

We assign weights to various parameters and quantify their market influence with the help of weighted average analysis, to derive an expected market growth rate

Income distribution, purchasing pattern, per capita income, and other end-user associated parameters

GDP, inflation rate, per capita disposable income, etc.

Expenditure, financial policies of the country, infrastructure and sector growth, and facilities

Source: International Market Research Analysis, 2024

International Market Research(IMR) is global leader in Market Research & Consulting services.